After decades of largely ineffective regulations, there is a growing consensus that decisive action on climate change by governments around the globe is now only a question of time. The UN Principles for Responsible Investing (UN PRI) is the world’s largest organisation of responsible investors, with more than 3,100 signatories who between them have more than USD 80 trillion of assets under management. In its pioneering ‘Inevitable Policy Response‘ (IPR) project, the UN PRI forecasts decisive action on climate change by financial regulators worldwide as soon as 2025 that will be “forceful, abrupt, and disorderly” – and there are signs that the engagement by investors with sustainability topics is only intensifying across the board in the wake of the Covid crisis. Among other things, the IPR may lead to the net present value of major fossil fuel assets being up to 50% lower than calculated during the planning phase for new projects.

How the TCFD Recommendations are Likely to Impact Your Business

We are already beginning to see the shape of these new regulations in the form of the recommendations by the Taskforce on Climate-related Financial Disclosures (TCFD) which were published in 2017. The Recommendations are now progressively finding their way into guidance and regulations prepared by supervisory institutions around the world. Most notably this includes the European Union, where the TCFD Recommendations have been integrated into guidance as part of its Sustainable Finance Action Plan. Around 6,000 listed companies, banks and insurance companies will now have to disclose information on sustainability related risks under the Non-Financial Reporting Directive.

Although many of these key developments appear to be driven by European decision makers, in a globalized world there are clear signals that corporations and financial institutions in Asia-Pacific will need to ramp up their engagement with climate related risks quickly to meet new investor requirements on disclosure and risk management:

- The Network of Central Banks and Supervisors for Greening the Financial System (NGFS), has altogether 66 members, including 15 central banks and financial regulators from Asia-Pacific, among them the central banks of Cambodia, Indonesia, Malaysia, Singapore and Thailand.

- Bank Negara announced in 2019 that it will work with financial institutions and non-financial firms to implement the TCFD recommendations for Malaysian institutions.

- Meanwhile Singapore sovereign wealth fund Temasek Holdings declared in October that it aims to halve greenhouse gas emissions of its entire portfolio by 2030

These developments have profound implications for anybody in the region who wants to ensure their company’s uninterrupted access to capital markets for funds.

In order to meet these new demands, even companies with significant experience in sustainability reporting and disclosure of non-financial performance metrics need new tools to determine the financial value of risks and opportunities arising from the physical impacts of climate change as well as from the transition to a rapidly decarbonising global economy.

How to implement the TCFD Recommendations

Part 1: Overview of the Recommendations

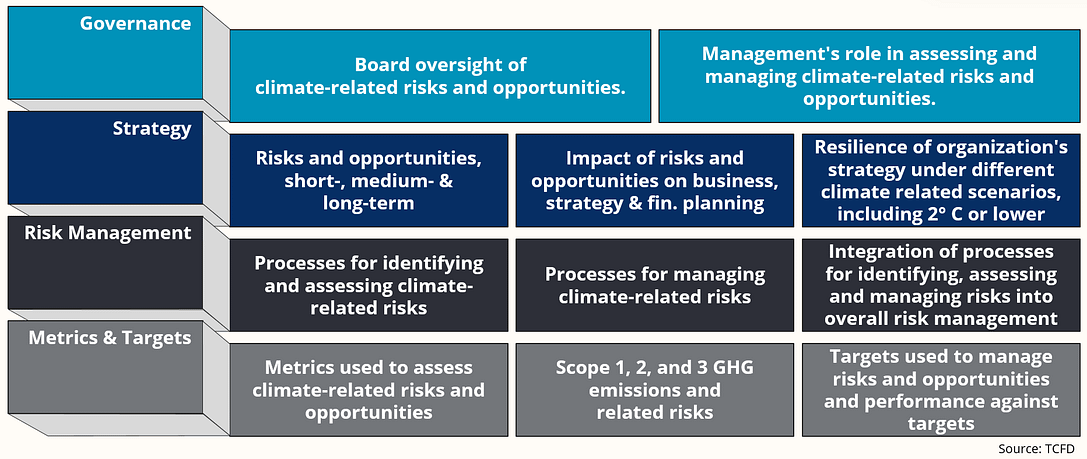

In their final report the Task Force made 11 specific recommendations, across four different domains:

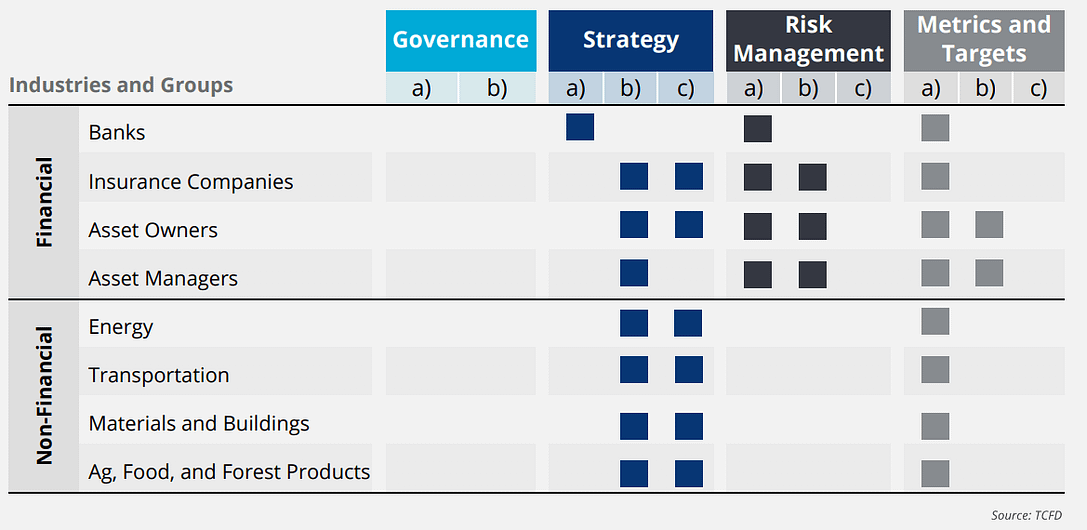

Along with the recommendations, the Task Force also published detailed implementation guidance for all sectors as well as supplemental guidance for the financial sector and non-financial groups “more likely to be financially impacted than others due to their exposure to certain transition and physical risks around greenhouse gas (GHG) emissions, energy, or water dependencies associated with their operations and products.”

Part 2: Implementing the Recommendations

Implementing the TCFD recommendations may seem daunting at first, but especially for companies with well-established sustainability reporting processes, there are significant synergies between the recommendations and what is being disclosed already. The Corporate Reporting Dialogue, a joint initiative by the main organisations providing guidance on sustainability reporting, published a detailed analysis in 2019 showing that the three major ‘general purpose’ sustainability disclosure frameworks are well aligned with the recommendations:

Especially companies reporting in accordance with the Global Reporting Initiative’s Standards, may therefore focus their efforts on scenario analysis. Recognising that this will be a new requirement even for leaders in sustainability, the Task Force again published detailed guidance on “The use of Scenario Analysis in Disclosure of Climate-Related Risks and Opportunities.”

Part 3: Integrating the Outcome of TCFD Scenario Analysis into the Company’s Strategy

The real value of the recommendations, however, lies in integrating the insights gained on specific climate-related risks and opportunities into the company’s strategy and decision making over different time horizons. For this purpose, we recommend using the output generated by a thorough scenario analysis as the main input for a subsequent Real Options analysis. Real Options borrow some basic concepts from financial options. They represent the right – but not an obligation – to exercise a given strategic option at a particular point in the future, e.g. when events confirm which of several scenarios analysed earlier is coming to pass.

Real Options are complementary to the concept of net present value and allow companies to develop their business by deliberately creating a series of decision points to maintain a number of different pathways that will allow them to respond decisively to rapidly evolving market conditions as climate change as well as the collective response to it unfold. At the same time, real options allow companies to minimise potential losses and maximise the return on their investments by creating checkpoints along the way to verify if original assumptions regarding the NPV of new projects are still valid or need to be adjusted.